Corrosion Free Packaging Products Biz For Sale In Rajkot

About Business

This is a contract manufacturing business specializing in export-grade, special-purpose packaging products designed to prevent rust and absorb moisture. The company operates in a niche market with limited competition, enjoying a near-monopoly due to the critical nature of its products for exporters and industrial clients. Once onboarded, customers typically remain long-term due to the high performance and reliability of the products.

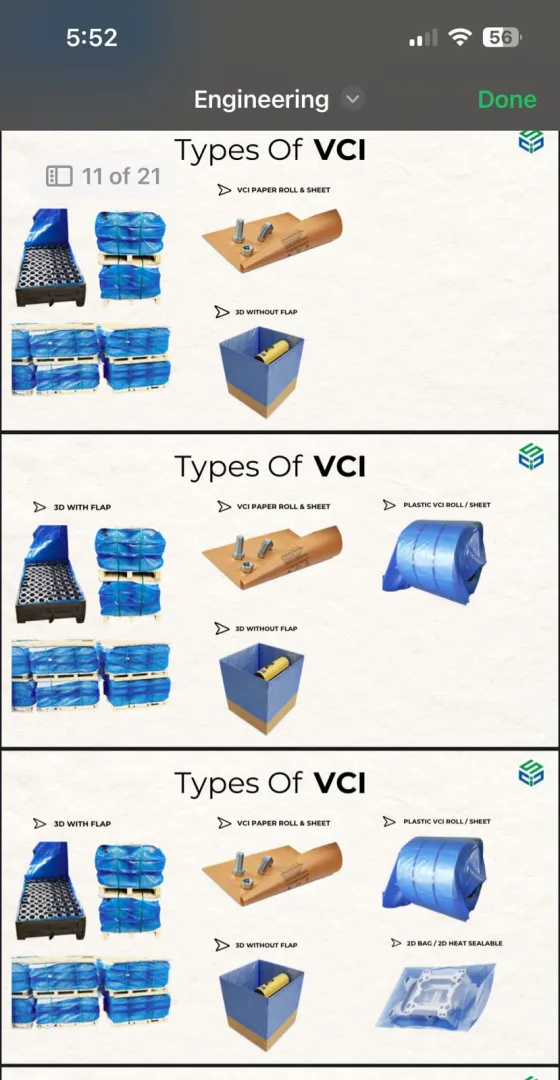

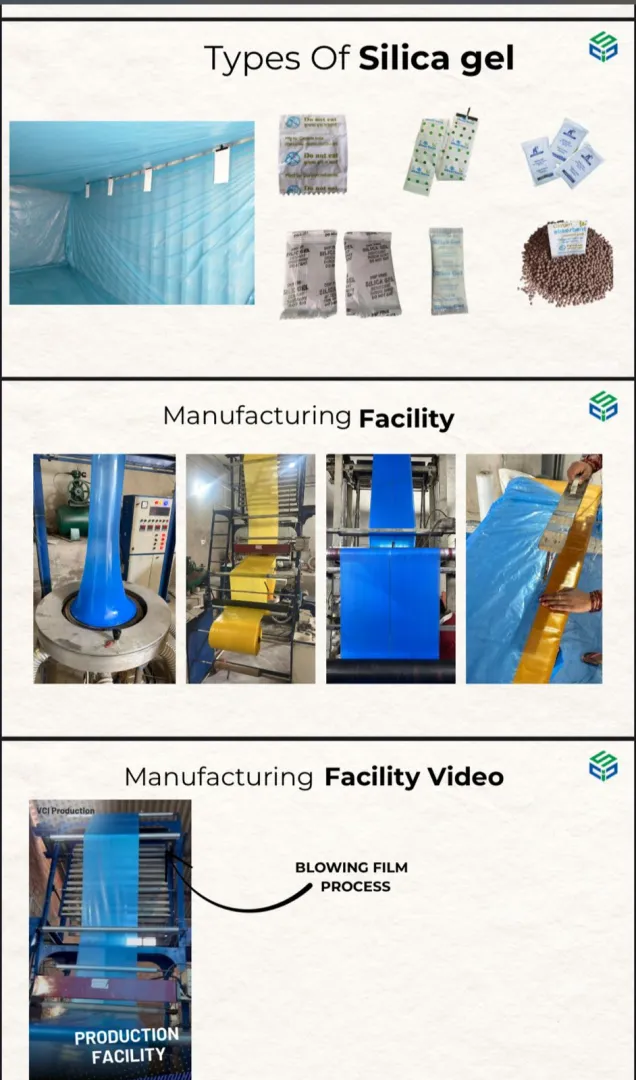

The business manufactures VCI (Volatile Corrosion Inhibitor) bags, which provide anti-rust protection without the need for oil, grease, or other hazardous materials. These packaging solutions are essential for protecting sensitive equipment and parts during storage and export. The company also manufactures silica gel products used for moisture absorption.

Currently, the business operates under four distinct brands, with the latest brand launched in January 2025. All manufacturing is done under contract with partner manufacturers, backed by formal agreements.

Clientele type

The business serves a specialized clientele across multiple industries, including:

Automotive industry

Warehousing & logistics

General engineering

Aeronautical parts suppliers

Agricultural exporters

Premises

OWNED

Premise Size: 200 sq. ft.

Market Value (in INR): 18.50 L

It operates from a business-owned premises spanning 200 sq.ft.

Asking Price Includes

The sale includes the entire business along with:

All registered brands

Customer database and ongoing contracts

Supplier relationships and contract manufacturing agreements

Full business handover support with a 3-month transition and operational backup

Reason

The owner is looking to exit the business in order to focus on another newly launched venture.

More Details

The company has built strong relationships with many clients, placing repeat orders for the past four years. The customer satisfaction rate is exceptionally high at 96%, supported by formal feedback.

The business has demonstrated consistent growth—from a turnover of ₹56 lakhs to ₹3 crore over the last five years—driven by repeat business and a strong word-of-mouth reputation.

Keywords

Business Tags

Business Exit for ₹10 Cr – 200 Cr

Structured Transition Completed in 120 Days

Credible Buyer Connections, Confidential Discussions, and Seamless Closure

Supported by Advisors with 26+ Years of Experience