A Healthcare IT Company From Pune Is Available For Strategic Growth

About Business

Cloud-based Hospital Information Management System, Laboratory Information Management System, Instruments Interfacing, Blood Bank Software

Clientele type

Hospital, Clinics, Diagnostic center, Pathology, Blood Bank

Premises

It's 500 sq. feet premises on lease. Monthly rent is INR 30,000 and security deposit is INR 60,000.

Asking Price Includes

Full sale, Intellectual Property Rights

Reason

Expansion and Manpower hiring

More Details

This Sole Proprietorship business is operational since 2016. They are Leading Healthcare IT Solutions provider for Hospitals, Clinics, Diagnostic Centers, Pathology Lab, Radiology, Pharmacy and Blood Banks.

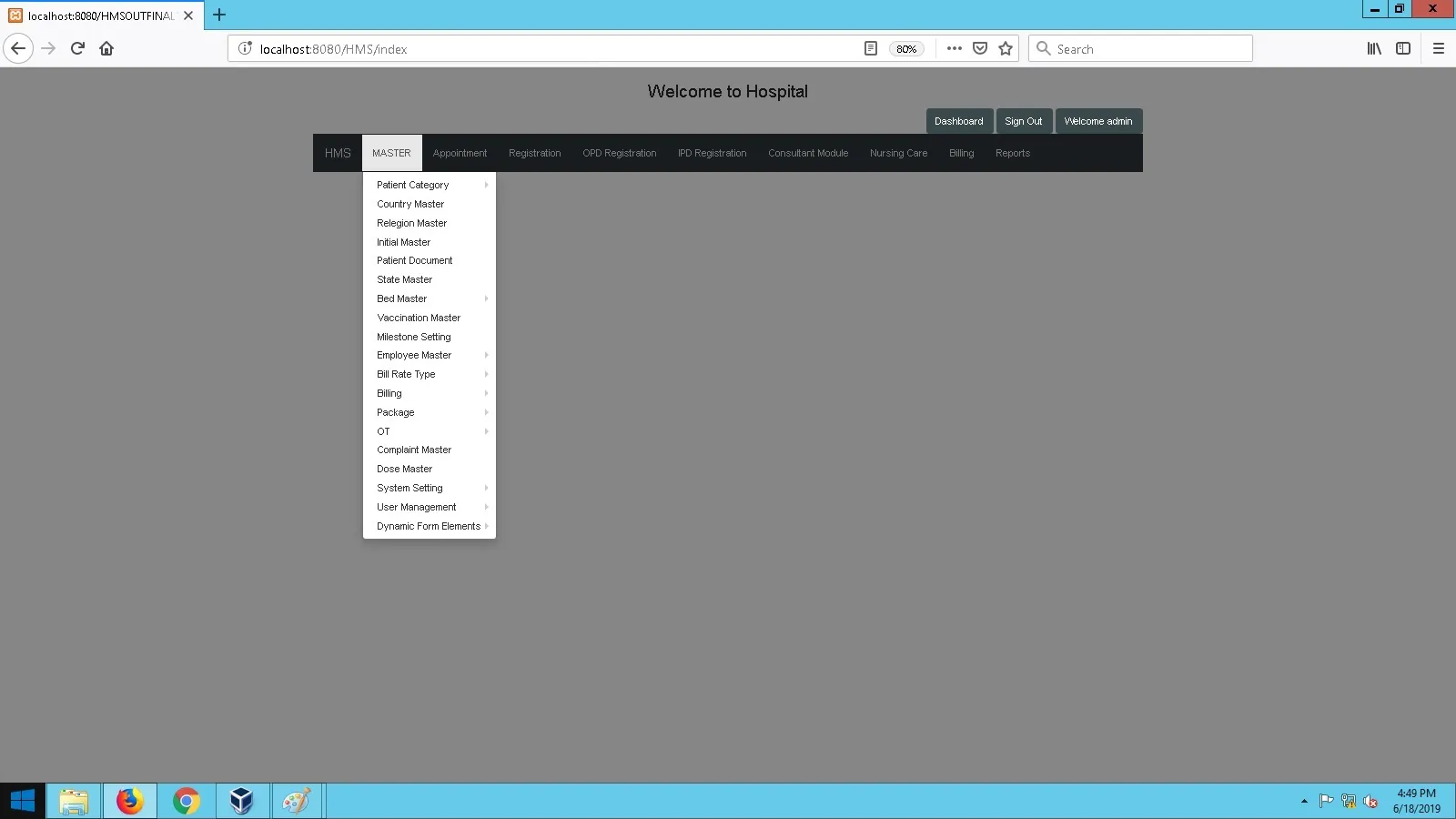

They have Developed and Working on the following modules:

Patient Registration Module (URN), Outpatient Management Module (OPD), Inpatient Management Module (IPD), Admission, Transfer, Discharge (ADT), Patient Care Module, Service Order Processing - Lab Test/Medical Prescription, Nursing Station, Doctors Scheduler, Patients Appointment Scheduler, Operation Theater Module,

EMR with Specialty Department, Central sterile services (CSSD), Central Store, Inventory, Billing, TPA (Insurance), Reporting Module (MIS), Blood Bank Module, Laboratory Information System, Interfacing with Instruments (Serial Port, TCPI IP, Socket, Network, USB), Radiology Information System, Picture Archiving and Communication System (PACS) Module, Integration, Third Party API Integration, Pharmacy Widget to View, Print Prescription.

Presently they have 2 clients in the pipeline based in Pune and Nashik.

They are now looking to Expand Pan India by hiring more manpower. Looking to raise INR 2 Cr. or

Full Sale INR 4 Cr.

Any other details required will be discussed with serious buyers/Investors

Keywords

Business Tags

₹10 Cr to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 26+ Years of Experienced Professional Team.