Profitable Fintech SAR Startup Raising Funds In Ahmedabad

About Business

About the Platform:

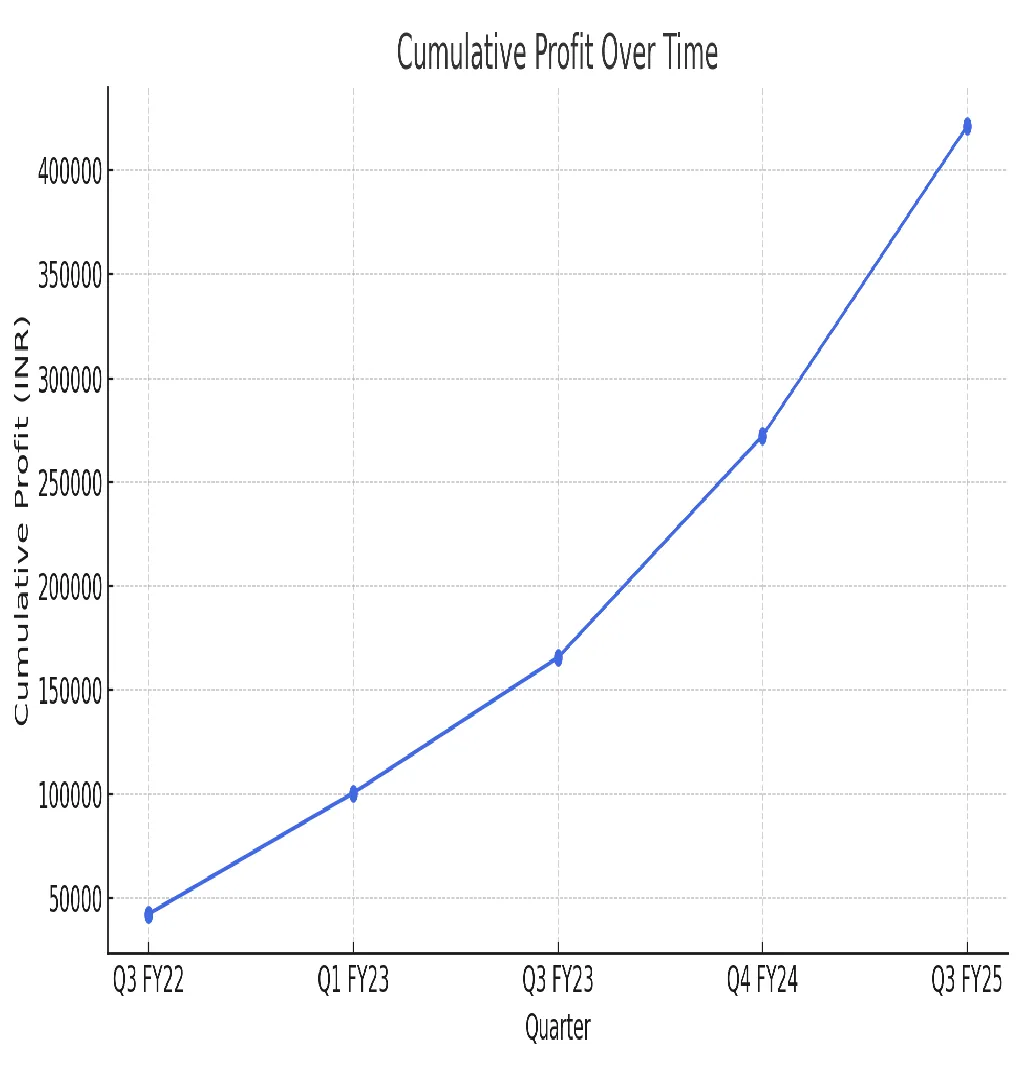

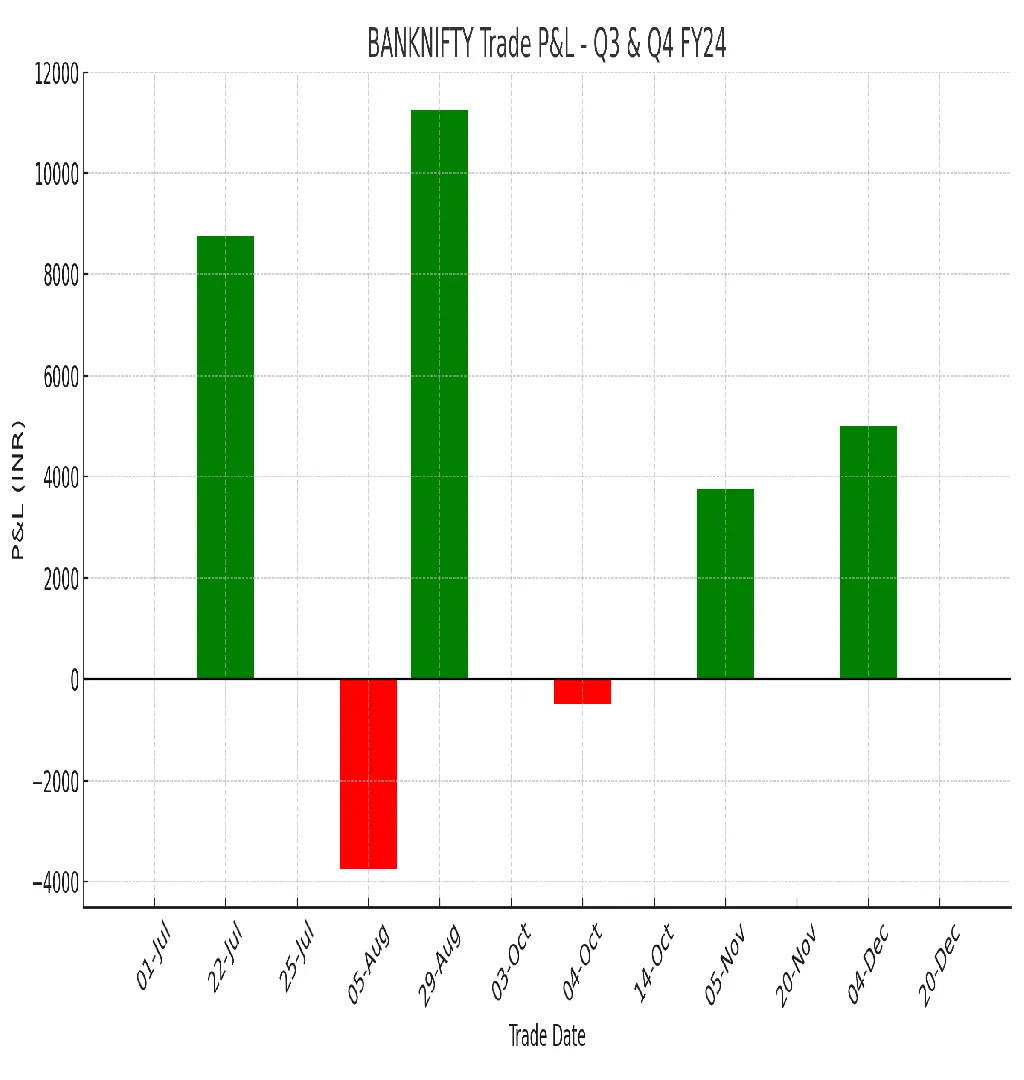

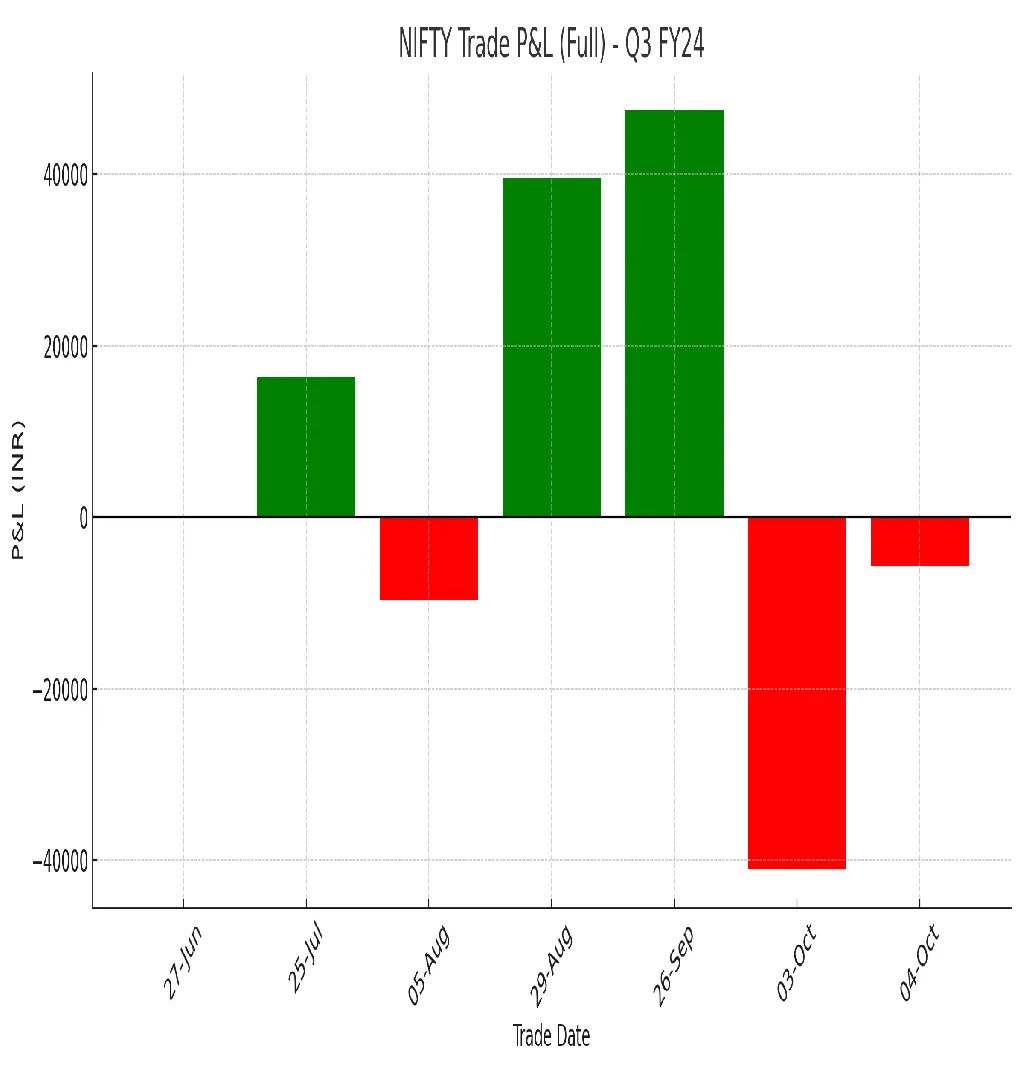

Born from a personal mission to eliminate emotion and speculation in trading, this fintech solution leverages over 20 years of finance and broking expertise to power the SAR (Systematic Analytical Returns) model—a market-agnostic, no-loss system that delivers steady returns in any market cycle.

How It Works:

- Discipline Over Emotion: Removes FOMO and guesswork, replacing it with a rules-based approach suitable for retail investors, HNIs, and institutions.

- Current Mode: Semi-manual advisory signals for NIFTY and BANKNIFTY, with demonstrated real-world accuracy and profitability.

- Roadmap: Fully automating SAR into a global plug-and-play SaaS platform.

Offering & Growth:

- Software Advisory: Clients get suggestions straight via our platform.

- Every INR 300,000 of investments costs INR 5,000 each month.

- Auto trading: futures derivatives can have automated execution.

- Client Reach: 100 active advisory accounts backing a total of 5,000 users.

Clientele type

Retail traders and investors, high-net-worth individuals, stock-market enthusiasts, business professionals, as well as financial advisors and brokers

Premises

OWNED

Premise Size: 600 Sq ft

Market Value (in INR): 70.00 L

Asking Price Includes

Deal terms will be negotiated directly with potential investors.

Asking Price

INR 2.00 Cr

Minimum ticket size

INR 50.00 L

Reason

Raising equity to automate SAR system, scale globally, and resolve immediate financial challenges.

Licenses

NISM Certifications (SEBI Recognized): Equity Derivatives Certification Mutual Fund Distribution Certification Insurance Certification (IRDAI-approved) Registered Broker Partner: Angel One Trade License: Registered under MSME/Udyam (India) Regulator

More Details

- Led by a finance veteran with 20+ years in banking and markets

- Developer of SAR, a proven zero-loss, systematic trading model

- Early real-world success with consistent profitability

- Alumni of top accelerators: DIFC Fintech Hive, Google for Startups, NSRCEL, Plug and Play, 500 Global

- Finalist in global fintech challenges (UAE, USA, Singapore, Australia)

- Vision: a global, automated platform that enforces discipline and zero-loss investing for retail and institutional traders

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?