Franchise Animation Institute For Sale in Delhi

About Business

Business Overview

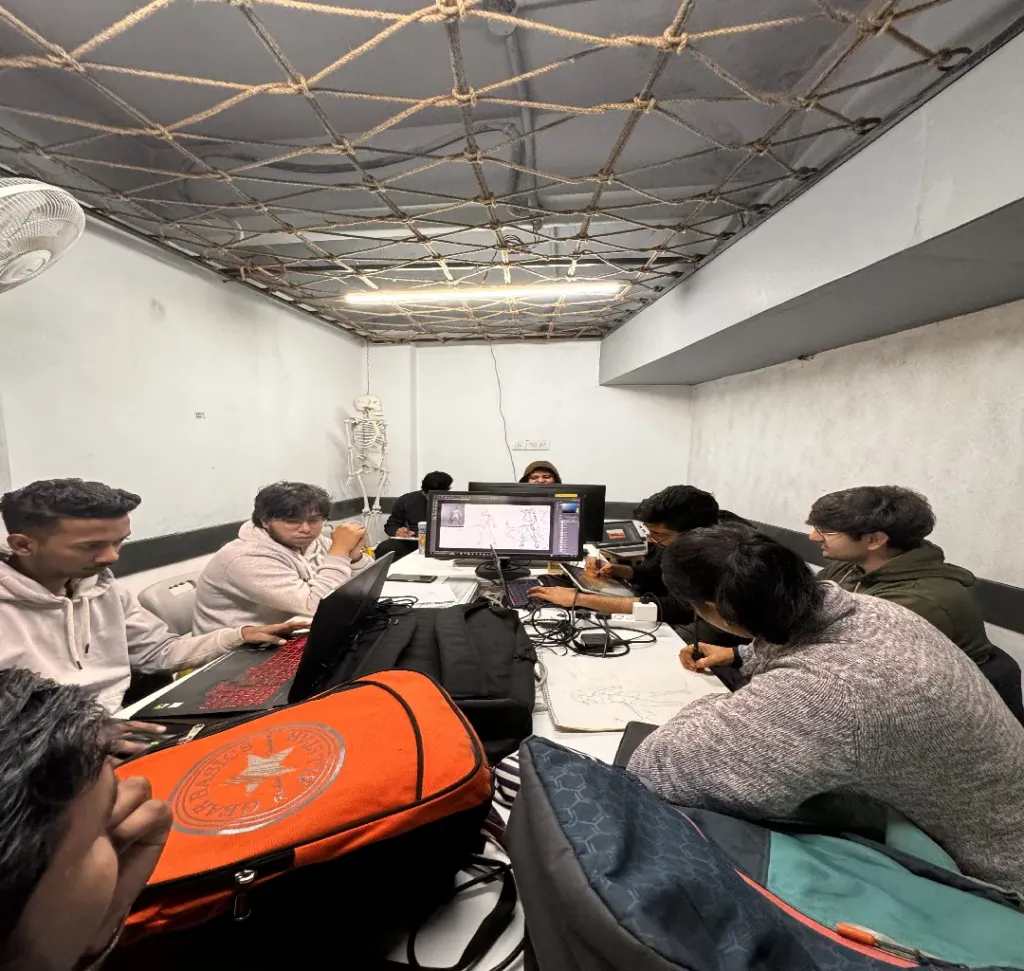

This is an opportunity to acquire two well-established franchise training centers in South Delhi. These centers provide specialized education in gaming, visual effects, animation, and digital marketing. The programs are designed for school students, college graduates, and working professionals, with structured placement support included.

Current Operations

The franchise currently operates three centers, out of which two centers located in South Delhi are available for sale. Each of these centers has over 100 active students enrolled. The business has maintained a strong track record, with approximately 80% of students successfully placed in relevant industries.

Financial Performance

The two South Delhi centers generate a combined monthly income of approximately ₹10 lakhs, with operating expenses around ₹5 lakhs, indicating consistent profitability.

Transaction Details

Only the physical training centers in South Delhi are being offered for sale.

The franchise operates under a reputed brand, but the brand name and trademark are not included in the transaction.

This is a center-level acquisition, suitable for investors or education operators looking to enter or expand in the creative and digital education sector.

Opportunity Summary

This is a profitable, ready-to-operate opportunity in a high-demand segment, supported by existing infrastructure, a strong student base, and a proven training model.

Clientele type

The primary clientele consists of students and working professionals.

Premises

LEASED

Lease per month (in INR): 1.45 L

Security Deposit (in INR): 2.00 L

Carpet Area: 3,000 sq ft

Asking Price Includes

The transaction includes two Delhi-based franchise centers, not the parent company. The sale covers all existing courses, enrolled students, and current staff associated with these centers.

Reason

The founder is relocating outside India and is therefore looking to sell the two Delhi-based centers.

More Details

The founder owns a company that operates three centers under a well-known franchise brand in the education and training sector.

Keywords

Business Tags

Business Exit for ₹10 Cr – 200 Cr

Structured Transition Completed in 120 Days

Credible Buyer Connections, Confidential Discussions, and Seamless Closure

Supported by Advisors with 26+ Years of Experience