NABL Accredited Civil-Material Testing Lab In Central Mumbai

About Business

NABL-Accredited Material Testing Lab for Sale in Mumbai

A well-established NABL-certified material testing facility is available for acquisition. Strategically located at the Wadala Truck Terminal, the lab enjoys excellent connectivity across Mumbai, ensuring ease of access for clients from all corners of the city.

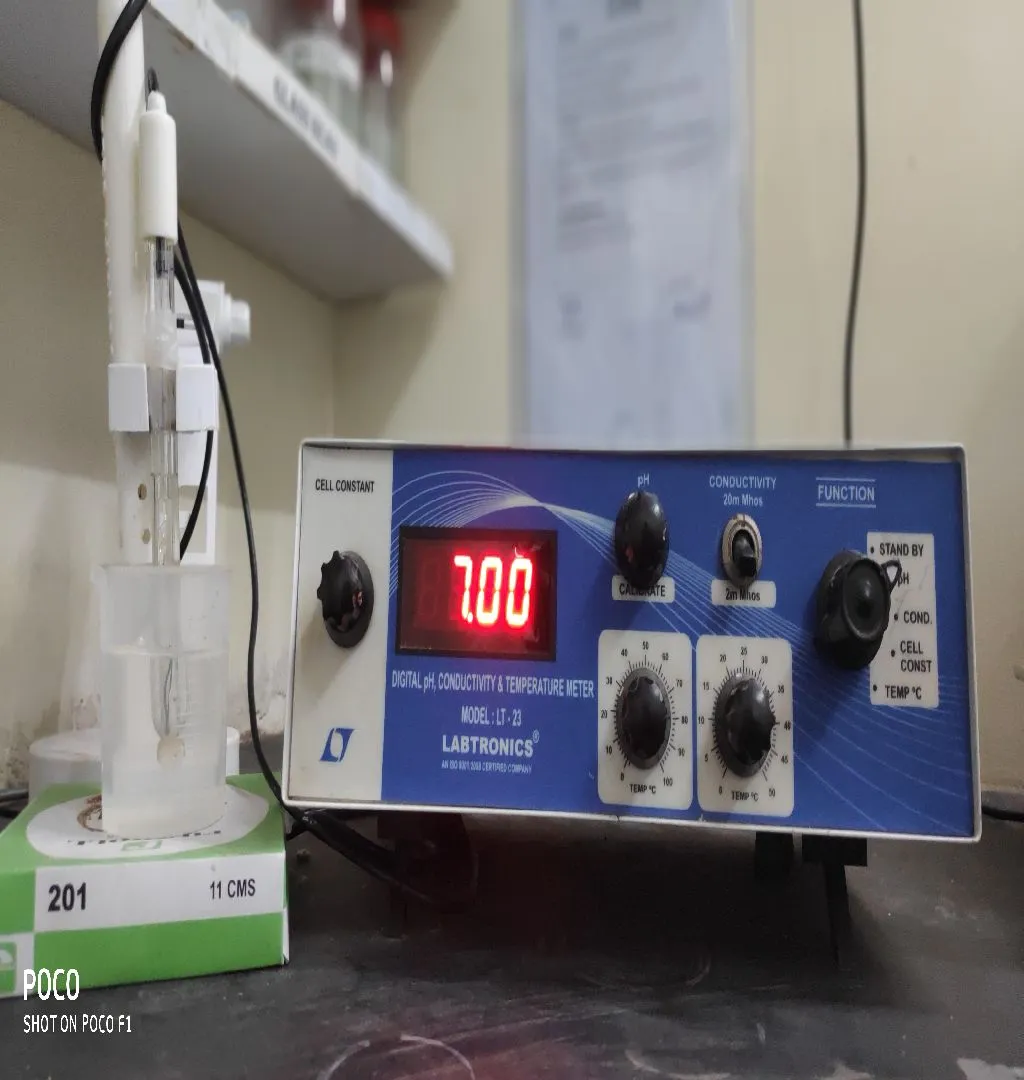

The facility offers a full spectrum of testing services tailored for the civil, structural, and geotechnical engineering sectors. Its offerings include:

-Mechanical Testing

-Chemical Testing

-Concrete Mix Design

-Non-Destructive Testing (NDT)

-Quality Consulting

This lab plays a crucial role in supporting infrastructure development projects by delivering reliable testing services for materials such as concrete, aggregates, asphalt, steel, and more. It operates with a strong focus on quality, timeliness, and adherence to international standards.

With a consistent growth rate ranging from 40% to 119% over the last two years, the business has positioned itself as a credible and dependable player in the infrastructure testing domain. It holds approvals from metro authorities and is empaneled with reputed contractors, further enhancing its industry standing.

Clientele type

Client Base & Revenue Model:

A significant portion of the company’s revenue—approximately 90%—is derived from large-scale infrastructure projects. These include landmark initiatives such as the Mumbai Metro, the Bullet Train corridor, and major urban sewerage developments. The client portfolio features prominent names such as Megha Infra, J. Kumar, L&T, Suez India, SMC Infra, Tata Projects, NCC, Ahluwalia, and Capacite.

Government-related assignments contribute roughly 7% of the business, with reputed clients including Shapoorji Pallonji, Tata Realty, Capacite, K Raheja, L&T Realty, and Godrej.

The remaining 3% of revenue is generated from smaller construction firms and independent builders. Service pricing varies based on requirements, typically ranging between INR 200 and INR 15,000 per assignment.

Premises

LEASED

Lease per month (in INR): 1.20 L

Security Deposit (in INR): 2.00 L

Carpet Area: 2,300 sq ft

Assets Overview:

The sale includes tangible assets comprising a wide range of testing equipment valued at approximately INR 1.2 crore. Additionally, the setup features a fully equipped laboratory dedicated to chemical testing.

Facilities Overview:

The business operates from a total of seven office units, five of which are situated within the same building. Combined, the operational space covers approximately 2,300 sq. ft., with a total monthly rental outflow of INR 1,25,000.

Asking Price Includes

The sale includes a fully functional NABL-accredited lab with professionally calibrated equipment, a skilled and experienced team, and a valid, renewable NABL certification. Nationwide-recognized credentials and an active client base enable immediate revenue generation. The existing pan-India clientele also offers strong potential for expansion into new markets.

Asking Price

INR 15.00 Cr

Minimum ticket size

INR 15.00 Cr

Reason

The owner plans to shift focus to other business ventures.

More Details

The company has a team of 34 employees across Mechanical, Non-Destructive, and Chemical departments, including Admin and Sales.

Contracts typically last 4-5 years, ensuring long-term business relationships. The HODs have over 15 years of experience, and employees receive regular training to enhance their skills. Over the last five years, the company has expanded from 3 to 26 employees and grown from a single office to five units.

An in-house software system streamlines report tracking and issuance, ensuring faster turnaround times compared to competitors.

Plans include expanding building material testing with advanced equipment, introducing a calibration facility for existing clients, adding geotechnical and petrochemical product testing, testing finished interior products, and establishing branches across India, leveraging NABL and government/Metro certifications.

Keywords

Business Tags

₹10 Cr to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 26+ Years of Experienced Professional Team.