As a seasoned professional with over a decade of experience navigating the intricate process of business exits, mergers, and acquisitions in India, I can confidently state that thorough due diligence is the single most crucial factor that distinguishes a seamless and high-value exit from a prolonged, contentious ordeal.

Whether you are an entrepreneur, who are preparing to sell, merge, or close your business, understanding and executing a robust business due diligence process is essential not only to comply with India’s evolving regulatory framework but also to safeguard your legacy, maximize valuation, and mitigate post-exit risks.

Importance of Business Due Diligence in India’s 2025 Environment

India’s regulatory environment has matured significantly in recent years driven by reforms in the Companies Act, GST regime, RoC digitalization, RBI/FEMA guidelines, and labor compliance regulations. Simultaneously, the demands of buyers, investors, and financial institutions have become considerably more exacting.

Data from the past five years highlights the high stakes: more than 106,000 firms have voluntarily exited the market, while private equity exits surged beyond $24 billion in 2024 alone. Buyers now expect comprehensive, transparent, and verifiable documentation at every step.

Failure to deliver rigorous due diligence undermines buyer confidence, prolongs deal cycles, and risks significant valuation discounts or outright deal collapse.

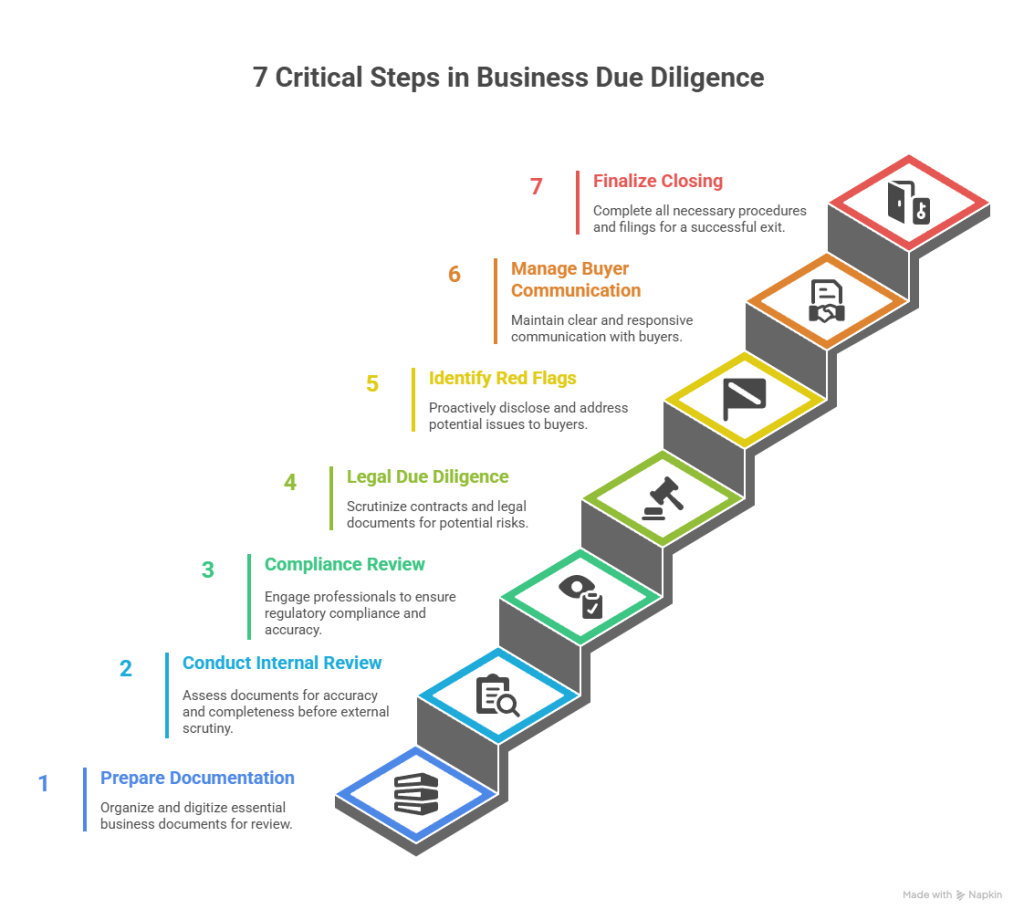

Step 1: Meticulous Preparation of Due Diligence Documentation

Establish a secure, well-structured digital data room – the modern equivalent of the traditional paper file cabinet. Ensure that it is organized by category and clearly indexed to facilitate buyer and advisory reviews.

Key Document Categories to Assemble:

- Corporate Governance: Certificate of incorporation, Memorandum and Articles of Association (MoA/AoA), Board and shareholder resolutions, statutory registers

- Financial Records: Audited financial statements (preferably 3–5 years), GST returns, income tax filings, TDS records, loan and credit facility agreements, cap tables

- Contracts and Agreements: Vendor, customer, employment contracts, NDAs, franchising or dealership agreements, lease agreements

- Compliance and Regulatory Filings: RoC annual filings, director KYC, RBI/FEMA submissions (for foreign investments), labor law compliance documentation (PF/ESI)

- Intellectual Property: Trademark, patent, copyright registrations, licenses, domain registrations

- Operational Assets: Asset registers, insurance policies, inventory records

Taking the time to prepare, digitize, and index these documents will pay dividends by streamlining buyer due diligence and reducing friction.

Step 2: Conducting a Thorough Internal Review

Before external scrutiny, do an critical self-assessment:

- Review all documents for currency, completeness, and accuracy.

- Verify that shareholder details match the RoC records and that share transfers are duly recorded.

- Confirm all contracts are valid, signed, and free from contradictions.

- Identify any overdue compliances like GST, PF, RoC filings, tax returns and promptly rectify.

- List all ongoing or potential litigation, regulatory notices, or disputes and prepare factual summary.

This internal audit serves to preempt surprises that can derail the process later and signals professionalism to prospective buyers.

Step 3: Compliance Review and Risk Mitigation

Engage qualified Chartered Accountants and compliance professionals to certify that regulatory filings and statutory obligations are current and accurately reported. This includes:

- Confirm all GST, TDS, and income tax filings, with no outstanding notices.

- Verification of labor compliance for employees, especially PF and ESI contribution.

- RBI/FEMA filing and foreign investment approval review where applicable.

- Verification of RoC filings – annual returns, director KYC, resolutions and confirmation of absence of penalties or show-cause notices.

Establishing a compliance dashboard or tracker summarizing these statuses is an effective way to present transparency and build buyer confidence.

Step 4: Legal Due Diligence – Contract and Risk Management Review

Legal due diligence is more than formality; it protects against latent liabilities and future litigation risks:

- Scrutinize all significant contracts for enforceability, renewal clauses, and any unusual indemnities or liabilities.

- Review shareholder and partnership agreements for completeness and consistency.

- Ensure all board and shareholder approvals are documented and filed as required under the Companies Act.

- Evaluate IP ownership clearances and registrations to safeguard transferability.

- Resolve or disclose any pending or threatened legal disputes with supporting evidence and planned resolutions.

Your legal team’s certification of these documents is essential to provide assurance and prevent post-deal liabilities.

Step 5: Identification and Transparent Disclosure of Red Flags

No business is without challenges. What differentiates successful exits is the proactive identification and transparent communication of risks such as:

- Unrecorded liabilities or informal debt arrangements.

- Ambiguities or discrepancies in the shareholding or cap table.

- Outstanding regulatory or tax disputes.

- Intellectual property ownership or infringement questions.

- Operational or environmental compliance issues.

Prepare an annotated risk register detailing each matter, along with remedial actions or planned negotiations. Buyers value honesty and are more willing to consider equitable adjustments when issues are disclosed early.

Step 6: Managing Buyer Due Diligence and Communication Efficiently

When granting access to your data room to buyers and their advisors, maintain a disciplined approach:

- Ensure role-based, secure access with appropriate confidentiality agreements.

- Appoint a dedicated point of contact to promptly handle information requests, clarifications, and additional document submissions.

- Track and log all buyer communications and responses for accountability.

- Provide clear, factual, and documented answers; avoid speculation or evasive replies.

Your responsiveness directly impacts buyer confidence and accelerates the negotiation process.

Step 7: Final Closing Procedures and Regulatory Compliance Wrap-Up

Pre-close and post-close obligations require strict attention:

- Obtain and archive all requisite No Objection Certificates (NOCs) from tax authorities, banks, creditors, and employees.

- Complete GST deregistration and income tax account closures.

- Settle outstanding employee dues properly—PF, gratuity, salary reconciliations—to avoid future claims.

- Submit final RoC filings confirming the closure or change in company status.

- Retain verified copies of all filings, certificates, and clearances as part of your closing binder.

Adhering to these final steps protects you from future liabilities and completes your exit on a strong legal and financial footing.

Realistic Timeframes and Market Data

- Business exits in India typically span 6 to 8 months, with well-prepared companies closing significantly faster than industry averages.

- Voluntary closures accounted for over 106,000 firms in the last five years; private equity and startup exits topped $24 billion and $19 billion in 2024 alone, respectively.

- Digitization of documents and a proactive compliance posture have become key differentiators in competitive deal environments.

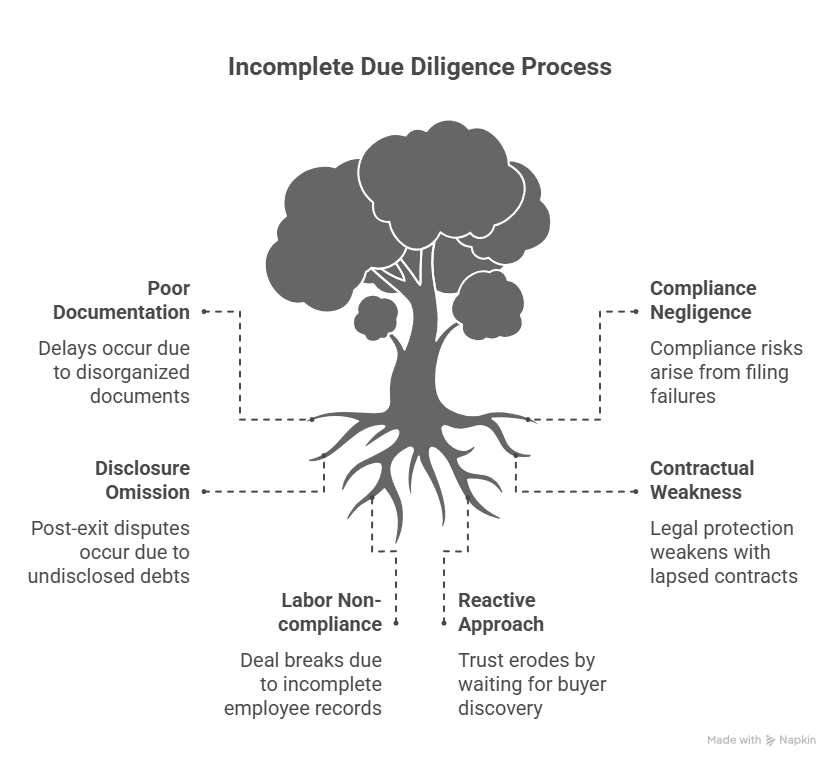

Common Mistakes to Avoid in Business Due Diligence

- Overlooking missing, outdated, or poorly organized documents leads to costly delays.

- Failing to keep up with RoC, GST, PF, or ESI filings creates compliance risks.

- Not disclosing informal debts, liabilities, or commitments sparks post-exit disputes.

- Allowing contracts to lapse or remain unsigned weakens legal protection.

- Incomplete employee records and non-compliance with labor laws cause deal-breakers.

- Waiting for buyers to spot issues rather than proactively addressing them erodes trust.

- Neglecting data room access controls puts confidential business information at risk.

avoiding these due diligence mistakes help you complete your business exit or fundraising deal efficiently.

Closing Thoughts – Leverage Experience for a Confident Exit

A decade’s worth of advising Indian business owners affirms this core truth: meticulous, transparent, and professionally coordinated business due diligence is non-negotiable.

It translates into tangible benefits, shorter transaction timelines, improved valuation multiples, and reduced post-transaction risk exposure. Most importantly, it safeguards your reputation as a diligent entrepreneur who respects the craft of business building and exiting.

If you have not already, begin building your due diligence framework today. Partner with experienced Chartered Accountants, legal advisors, compliance specialists and Investment banking team such as IBGrid who understand the nuances unique to India’s evolving business and regulatory environment.

Invest in robust due diligence, and you invest in the peace of mind and legacy you deserve.

If you seek assistance tailoring your due diligence process or require practical tools and checklists, I am here to help guide you through the nuances of a successful exit journey. Reach out when ready.

You can write me at [email protected].