In 2025, buying established businesses has become an increasingly popular strategy among entrepreneurs, investors, and companies worldwide. The preference for acquisitions over starting from scratch stems from a combination of market dynamics, strategic growth goals, and financial incentives.

This trend is backed by robust data showing a significant rise in mergers and acquisitions (M&A) activity across various sectors and geographies.

This blog explores why buying businesses has become the preferred path in 2025, backed by fresh statistics, sectoral insights, and practical guidance for anyone considering this path.

The Rising Tide of Business Acquisitions: Market Data Insights

The numbers paint a clear picture of the growing momentum in business buying:

- India’s M&A surge: In Q1 2025, India recorded 669 M&A deals valued at $29 billion—a 43% increase in deal volume and 17% increase in value compared to the previous year. Domestic transactions constituted 72% of these deals, reflecting a strong preference for local market expansion and risk mitigation.

- Global growth in deal value: Globally, despite a slight 9% drop in the number of transactions, total deal value rose by 15% year-over-year, reaching around $1.5 trillion. This indicates a market shift towards larger, more strategic acquisitions. Technology, energy, and financial services sectors have led this growth with major deals driving consolidation and innovation.

- Sector-specific trends: The energy sector in India saw deal values increase more than 15 times, largely driven by renewable energy consolidation. In technology, AI integrations and digital infrastructure acquisitions account for over half of the ongoing deal activity worldwide.

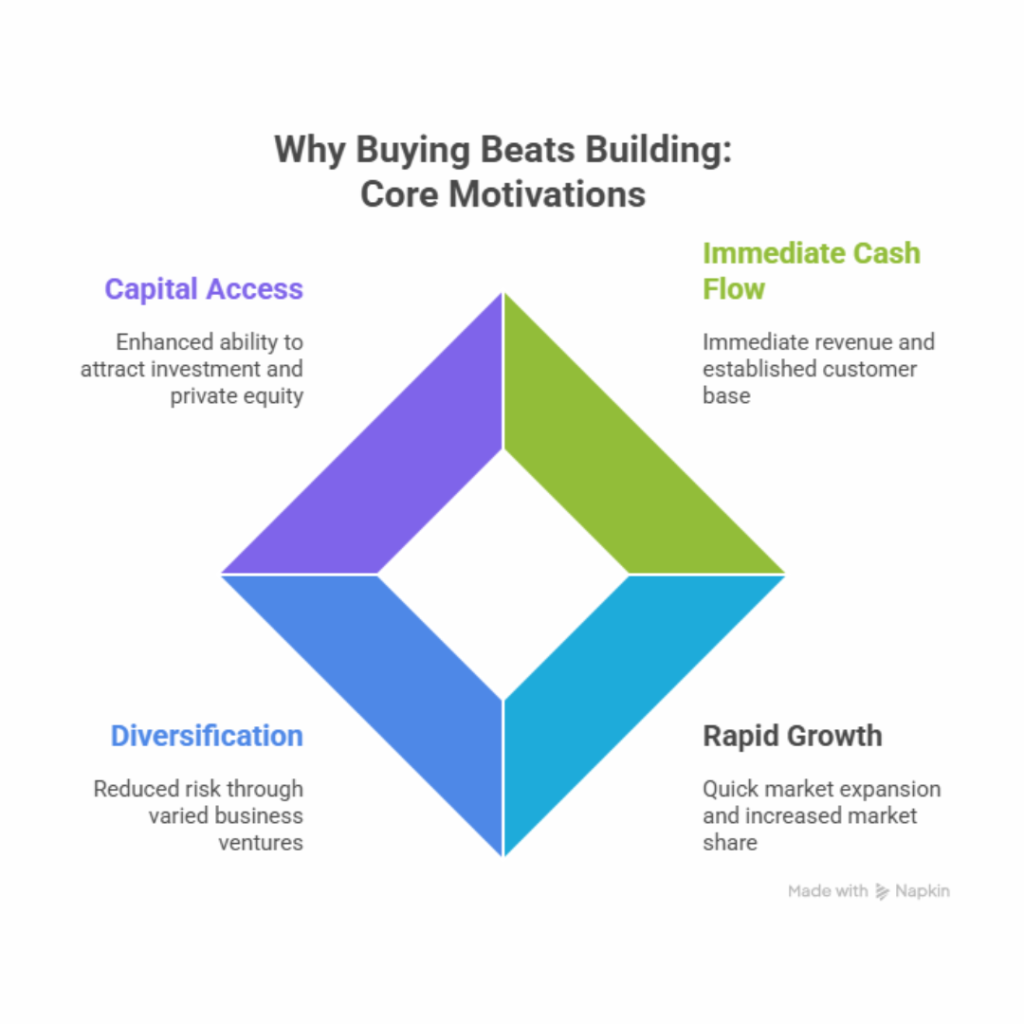

Why Buying Beats Building: Core Motivations

There are clear business reasons why buying wins over building new ventures:

1. Immediate Cash Flow and Customer Base

Purchased businesses come with existing revenue streams, loyal customers, and operational infrastructure. Unlike startups that require time-intensive customer acquisition and business development, acquisitions provide instant market presence and cash flow, reducing early-stage failure risks.

2. Rapid Growth and Market Expansion

Buying a business often means tapping into new geographies, product lines, or service capabilities without the delays of organic growth. This approach allows companies to quickly scale, meet customer demands, and outpace competitors. Top deals in tech and energy reflect this trend, where speed to market is critical.

3. Diversification and Risk Management

Frequent buyers use acquisitions to hedge against the volatility of their original markets. Expanding into new sectors like AI, fintech, healthcare, or green energy creates a more resilient portfolio diversified across industries and customer bases.

4. Access to Investment Capital and Private Equity

Abundant capital from private equity firms is fueling acquisitions. Private equity-backed deal volumes surged by over 200% in India, supporting growing demand for frequent business purchases.

Worldwide, significant pools of investment funds (often called “dry powder”) are actively seeking quality acquisition targets, especially in fast-growing or transformative sectors.

The Hidden Player Influencing Business Buying

Online platforms have transformed how businesses are bought and sold, making the process faster, safer, and more accessible. These digital marketplaces allow buyers to browse thousands of verified listings, save significant time searching, and connect securely with sellers. They also offer tools to streamline due diligence and negotiations, making acquisitions easier even for first-time buyers.

Key advantages of online business buying platforms include:

- Verified and trusted listings reducing fraud risks

- Automated matching based on buyer preferences

- Confidential communication between buyers and sellers

- Access to off-market deals through AI-powered sourcing

- Integrated deal management tools to simplify paperwork and processes

- Connection to professional advisors and financing options

These features are a major reason why more entrepreneurs and investors are buying businesses frequently in 2025.

What Buyers Look For When Acquiring Businesses

Buyers evaluate several key factors before making a purchase:

- Stable, loyal customer base: Ensures continued revenue generation post-acquisition.

- Scalable and efficient operations: Facilitates smooth integration and growth.

- Strategic fit: Alignment with existing businesses or future market plans.

- Financial health: Strong earnings before interest, taxes, depreciation, and amortization (EBITDA) and positive cash flow.

- Market positioning: Opportunity to enter or strengthen position in growing markets.

The Acquisition Process: Step-by-Step Overview

Buying a business is a structured process often divided into eight steps:

- Establish clear acquisition motives: Define your goals such as diversification, market expansion, or competitive leverage.

- Set precise search criteria: Include industry, geography, customer base, and price range.

- Research potential targets: Use databases, brokers, and direct outreach.

- Initiate contact and negotiate: Build rapport, evaluate interest, and sign confidentiality agreements.

- Conduct due diligence: Carefully analyze financials, operations, legal risks, and market conditions.

- Make an offer: Align your proposal with market valuations and seller expectations.

- Final legal and regulatory approvals: Draft agreements and comply with necessary regulations.

- Close and integrate: Ensure smooth operational merging and realize synergies.

Benefits and Risks of Frequent Business Buying

Benefits

- Rapid scale and market access

- Instant cash flow

- Diversification benefits

- Talent acquisition and operational synergies

- Access to new technologies and markets

You can check top 10 benefits of buying business in 2025 that will give you more in-depth insights.

Risks

- Overpaying or poor valuation

- Integration challenges and culture clashes

- Hidden liabilities uncovered in due diligence

- Potential distraction from core business operations

- Market or regulatory shifts affecting business value

Proper planning, research, and expert consultation mitigate most risks while maximizing advantages.

FAQs: Common Questions About Buying Businesses

Q: Why are businesses being bought more frequently now?

A: Strategic imperatives, access to capital, desire for quick growth, and reduced startup risks drive this surge.

Q: Which sectors see the fastest growth in acquisitions?

A: Technology (especially AI), renewable energy, financial services, and healthcare dominate 2025 acquisition trends.

Q: Should I buy a business or start one from scratch?

A: Buying is advantageous for immediate scale and lower risk but depends on individual goals, experience, and available capital.

Q: Why are people selling their business?

A: Most common reasons we found (after talking with 100,000+ businesses and making thousands of them live on IndiaBizForSale), the most common reasons of selling we got from sellers are either they want to retire, have multiple businesses and want to sell them one, no successor, moving abroad, want to start something new.

Final Thoughts: Why Buying Is the Smart Choice in 2025

With strong market data proving increased acquisition activity globally, buying businesses frequently is clearly a strategic choice for growth, diversification, and investment profitability.

Entrepreneurs and investors benefit from accessing tested systems, dedicated customer bases, and operational efficiencies rather than developing anew.

For anyone considering entrepreneurship or portfolio growth, understanding these dynamics is essential. With careful selection, due diligence, and expert advice, buying a business can unlock faster paths to success and resilience in today’s competitive environment.